What Are the Key Features That Make MetaTrader 5 a Must-Have?

Making smart trading decisions requires a clear understanding of market trends and risk management strategies. A multi-asset trading platform allows users to diversify investments across different financial instruments for better opportunities. They ensure security, transparency, and seamless execution of trades without unnecessary risks. Many investors rely on automated buying and selling strategies to enhance efficiency and remove emotional biases.

With MetaTrader 5, shareholders can access advanced charting tools, multiple order types, and robust analytical features. Expanding the right knowledge helps users build confidence, improve decision-making, and navigate financial markets. Here, we focus on essential features, benefits, and functionalities of automated trading solutions. Hence, users can maximize potential gains and develop a more strategic approach.

Advanced Multi-Asset Buying and Selling Capabilities

Shareholders need a reliable platform that provides access to multiple financial instruments. Automated solutions offer multi-asset support, allowing users to trade forex, stocks, commodities, and indices. This feature will enable investors to diversify their portfolios without switching between different platforms. A single interface simplifies the buying and selling, making market participation seamless and efficient.

Multi-asset trading enhances the ability to analyze price movements across different markets. Users can take advantage of diverse investment opportunities within a unified environment. Having access to multiple asset classes helps reduce overall risk exposure. Professional guidance ensures users make informed choices while navigating complex market conditions.

Superior Charting and Analytical Tools

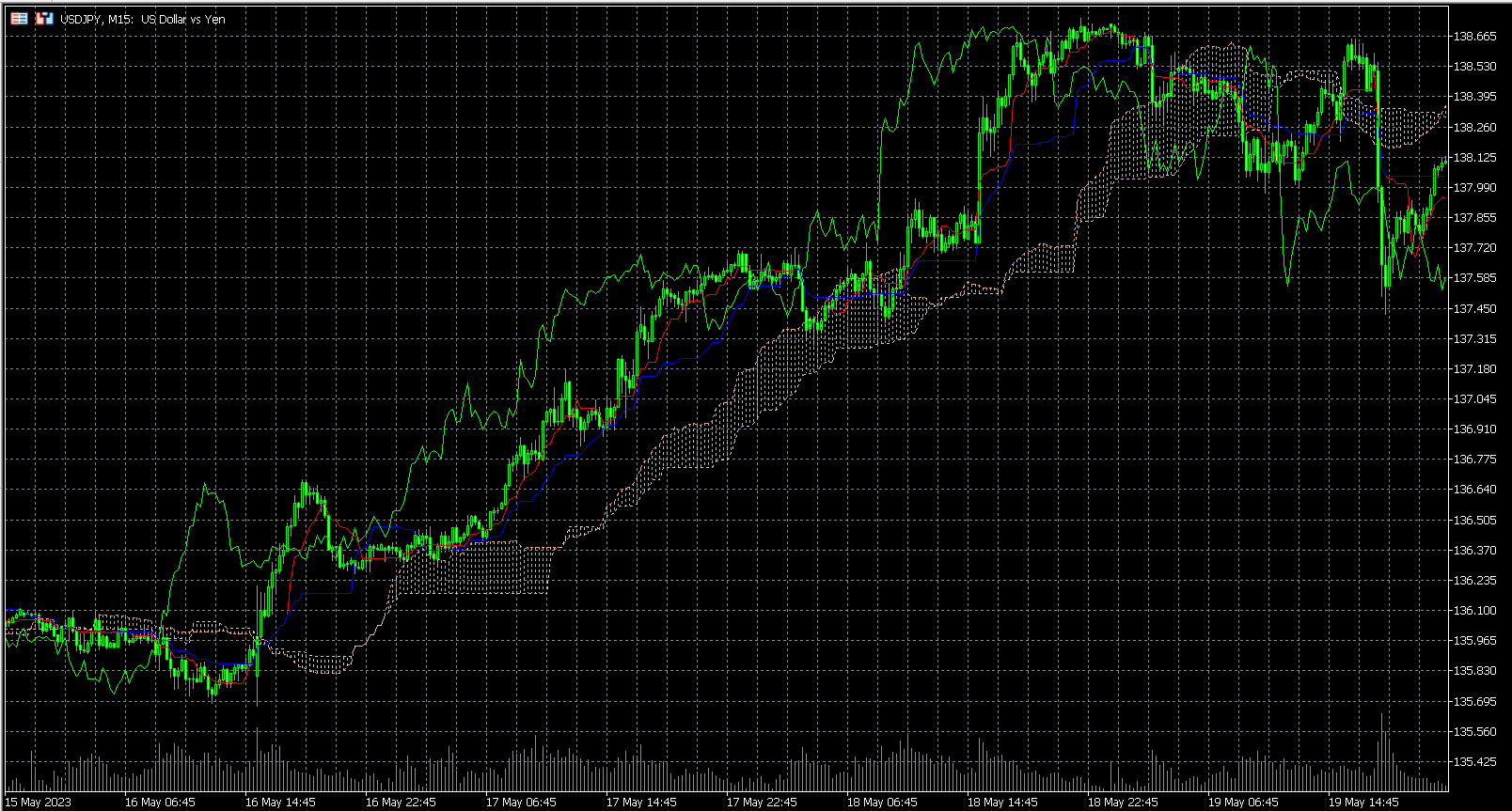

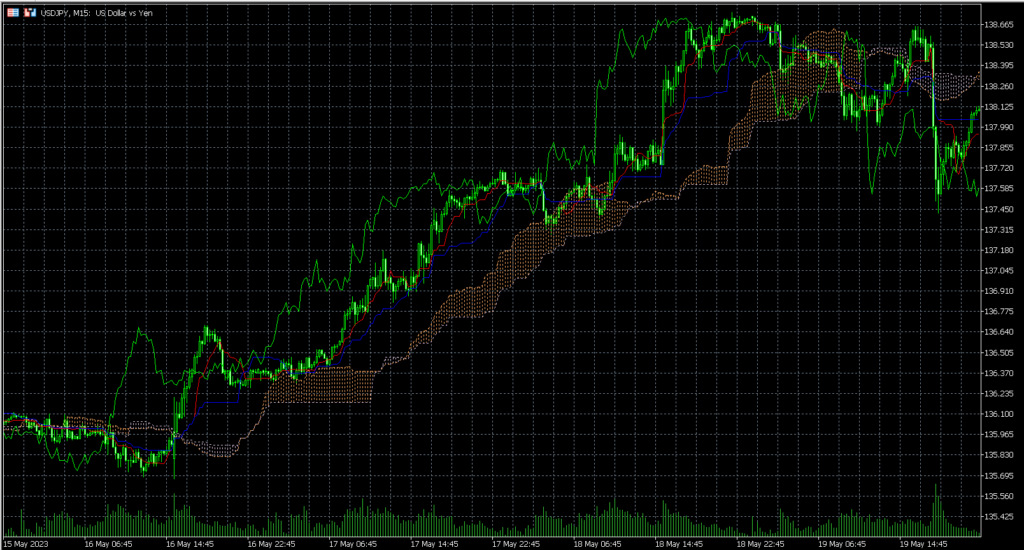

Successful buying and selling requires robust charting tools that provide accurate insights into price movements. Cutting-edge tools include 21 timeframes, allowing users to conduct precise technical analysis. Identifying trends becomes straightforward with a wide selection of indicators and graphical tools. The platform ensures that investors can access real-time data to make informed decisions.

Built-in analytical tools help traders refine their strategies for optimal market performance. Professional systems support various chart types, including candlestick, line, and bar charts. Users can apply multiple indicators simultaneously to fine-tune their analysis. Reliable online portals equip investors with the tools to interpret technical data efficiently.

Advanced Automated Trading and Algorithmic Strategies

Automation plays a crucial role in improving trading efficiency and consistency. Feature-rich platforms allow users to implement automated trading strategies using Expert Advisors (EAs). These computerized programs execute trades based on predefined rules without requiring manual intervention. Algorithmic buying and selling enhances decision-making by eliminating emotional biases and human errors.

Investors can develop and backtest custom algorithms to optimize their strategies. The platform provides a built-in programming language called MQL5 for creating sophisticated trading bots. With advanced automation, traders can capitalize on market opportunities around the clock. Trusted partners offer expert insights to refine and enhance algorithmic strategies.

Integrated Economic Calendar and Fundamental Analysis Tools

Understanding economic trends is essential for making informed trading decisions. Multi-asset footwear includes an integrated economic calendar that provides real-time updates on financial events. Users can monitor global news, interest rate decisions, and inflation reports directly within the platform. These insights help in predicting potential market movements accurately.

Fundamental analysis tools allow investors to assess market sentiment. Investors can anticipate price fluctuations in different asset classes by analyzing key economic indicators. Tracking fundamental data directly from the trading interface saves time and effort. Reliable financial platforms ensure users access accurate information for sound decision-making.

Fast Order Execution and Depth of Market Functionality

Speed is critical in online trading, and multi-asset software ensures rapid order execution. These platforms support advanced order execution types, including market, limit, and stop orders. A high-speed trading engine reduces slippage and enhances buying and selling accuracy. Users benefit from a seamless experience when entering or exiting the market quickly.

Depth of Market (DOM) functionality provides insight into real-time liquidity levels. This feature allows users to analyze the supply and demand of financial instruments. By understanding order book dynamics, investors can make well-informed decisions. A trusted trading environment ensures smooth transactions with minimal execution delays.

Mobile and Web Trading Flexibility

Modern traders require access to financial markets from anywhere at any time. Cutting-edge tools offer mobile and web-based buying and selling options to ensure convenience. The mobile application is compatible with iOS and Android devices, providing a seamless experience. With a user-friendly interface, users can monitor and manage their accounts.

The web trading platform eliminates the need for software downloads. Users can access their trading accounts through a browser without compromising functionality. This feature enhances accessibility while maintaining high security and reliability. Dependable trading platforms provide a secure and efficient experience for traders on the move.

Successful trading begins with understanding the essential tools and features that enhance market analysis efficiency. Exploring MetaTrader 5 ensures traders utilize advanced indicators, order execution options, and risk management techniques. Mastering these features helps traders make informed decisions, minimize losses, and optimize trading performance. Embracing its powerful tools provides a competitive edge, ensuring a smoother and more rewarding trading experience.

- Grocery Greats of Summer: How To Shop Using Reliance Smart Point Gift Vouchers From GyFTR

- Stranger Things Season 5 Release Date: What We Know So Far

- Become a Leader in AI-Driven Healthcare: Transform Your Career with Cutting-Edge Skills

- 7 Surprising Benefits of Digital Document Management

- How to Safely Replace or Upgrade Gun Parts